In order to be eligible for a grant, the enterprise must have recorded a decrease in turnover which is mainly due to the coronavirus pandemic.

Help on how to calculate this is given below.

Decrease in turnover of at least 30 percent

In order to be eligible for a grant for the period november 2021 – february 2022, the decrease in turnover must have amounted to at least 30 percent during the grant period compared with the comparative period.

How to calculate the decrease in turnover for the grant period

To determine the decrease in turnover, you must compare the enterprise’s actual turnover during the grant period with the turnover during the corresponding period two years before (the comparative period). For January and February 2022, you must use the turnover in the corresponding period three years before as the basis for comparison. When calculating the decrease in turnover, the turnover for the comparative period is adjusted upwards in accordance with the consumer price index. The decrease in turnover constitutes the difference between the turnover during the comparative period and the actual turnover during the grant period.

If your enterprise was launched less than two years prior to the period for which you are applying for compensation, you must use the average turnover from January and February 2020 as basis for comparison. For the grant periods January and February 2022, this applies to enterprises launched less than three years prior to the period for which you are applying for compensation. The same applies for enterprises registered but with no turnover in the relevant comparison period.

Enterprises that were part of a merger during the comparative period or later may include the turnover from the transferring company.

Enterprises that were the transferor or transferee in a demerger registered as completed in the Register of Business Enterprises during the period 1 Mars 2019 to 31 December 2019 must use the average turnover from January and February 2020 as the basis for determining the decrease in turnover.

Enterprises which acted as the transferor or transferee in a demerger registered as being completed in the Register of Business Enterprises during the period 1 January to 29 February 2020 and which are not covered by the exemptions in Section 1-3 second paragraph (a) – (c) must use the turnover after the demerger in this period as a basis for calculating the decrease in turnover.

You must use the following figures:

For the grant period, you must provide details of income from sales of delivered goods and services performed, even if they have not been invoiced. Sales of goods and services must be within industries which are covered by the scheme. It is the grant period as a whole that must be used as a basis.

Turnover also includes income safeguards as compensation for income, including government subsidy schemes provided in connection with the coronavirus pandemic. However, this does not apply to grants awarded under the general compensation scheme, or to aid from municipalities awarded in accordance with the regulations concerning de minimis aid. Compensation for lost stock is also not considered to constitute turnover.

For sole proprietorships and partners in general partnerships, sickness benefit, parental benefit, care allowance and carer’s allowance are regarded as turnover

Income or return on capital, property and other financial assets must not be included. However, rental income from property is still considered to constitute turnover.

When donating lost stock to charitable purposes, this may lead to an increase in the income. This income should not be considered as turnover according to the Regulations. The gift will therefore not affect the calculated loss of turnover, even though the gift should be treated in the accounts as income liable to taxation.

For the comparative period, you must provide details of income from sales of goods delivered and services provided. Sales of goods and services must be within industries which are covered by the scheme in Norway. It is the period as a whole that must be used as a basis.

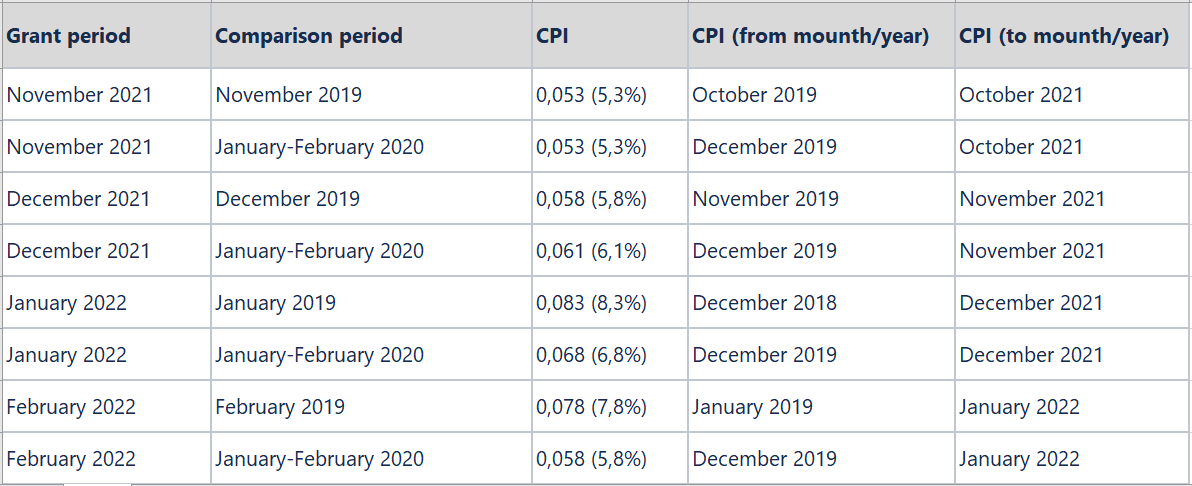

The figures for the comparison period are adjusted upwards with the change in the consumer price index.

Overview of the CPI used in the various comparison periods:

Enterprise A recorded the following turnover:

Comparison period November 2019: NOK 80,000, which is automatically adjusted upwards with the consumer price index to NOK 84,241

Grant period November 2021: NOK 50,000

The decrease in turnover is therefore 84,241 – 50,000 = NOK 34, 241.

Decrease in turnover in percent: 34,241/84,241 * 100 = 40.65%

As the decrease in turnover is more than 30%, the enterprise can apply for a grant for the period November 2021, provided that it meets the other requirements.

Consumer price index – calculator