In order to apply for grants as a result of a decrease in turnover, it is a condition that the enterprise is able to document that it recorded a deficit during the grant period.

The grant cannot exceed the loss calculated by the enterprise or group for the grant period

- multiplied by 0.9 for small enterprises, and

- multiplied by 0.7 for medium and large enterprises.

However, this limitation does not apply if the enterprise only applies for compensation for lost stock.

The calculation of the deficit should be based on accrued accounts for the grant period.

For organisations that are required to compile and submit annual accounts, the accrual should be based on the accounting policies that the enterprise applies in its annual accounts. For other enterprises, fiscal accrual policies may be applied.

According to the provisions of this Regulation, the turnover must be deducted from costs.

This means that, if you have a surplus, a negative amount will be obtained.

If the calculation results in a negative amount (i.e. a surplus), this must be entered as “0” in the section in the application form entitled “Deficit during the application period”.

Attention – Regarding loss of stock

If you apply for compensation for loss of stock, the compensation will reduce the operating loss for the period. This could impact the compensation for unavoidable fixed costs for the grant period.

Costs

Costs included in the calculation:

- Salary and other personnel costs

- Cost of goods

- Change in inventory of semi-finished and finished goods

- Depreciation of fixed assets and intangible assets

- Other operating costs

- Net interest expense in accordance with Section 3-2 third paragraph, but such that the negative net interest cost must also be included

About costs

Costs must be attributable to the grant period concerned.

Costs must be reduced by public subsidies, compensation payments from insurance companies and other reimbursements for costs incurred during the grant period.

Cost of goods

However, the cost of goods should not be reduced by compensation for lost stock in accordance with Section 3-6 of the Regulation. When the application is submitted, compensation for lost stock will automatically be deducted from the calculated deficit when the grant is determined.

The accrued cost of goods during the grant period will be used. These are costs for procurement, shipping, packaging, etc. on goods sold during the grant period. The cost of wastage may also be included.

Enterprises which either know or are able to determine without major effort the actual cost of goods should use this cost. Any estimate of wastage must be empirical (based on past experience). Enterprises that have integrated logistics management into their financial system will be expected to apply this method. The same applies to dealers with clear movement in their inventory, such as dealers of small quantities of expensive capital goods.

Other enterprises may base the calculation of the cost of goods on appropriate estimates, e.g. based on the cost of goods during comparable periods, theoretical gross profit or goods purchases made during the period adjusted for estimated change in stock. The estimates must be based on documented empirical figures.

About turnover

The turnover which is to be deducted from costs includes:

- the turnover in accordance with the provision of Section 2-2 of the Regulation (the same figure that was used as a basis for calculating the decrease in turnover)

- other financial compensation

- other public subsidies, such as unspecified aid from municipalities that is provided in accordance with the regulations concerning de minimis aid. This could include grants from municipalities that have been granted to compensate for loss of income or a deficit/loss as a result of the coronavirus pandemic, referred to by some municipalities as an ‘operating subsidy’. Such grants are regarded as financial compensation pursuant to Section 3-9 fourth paragraph of the Regulation when the grant concerns the grant period and should not be included when calculating the decrease in turnover pursuant to Section 2-2 second paragraph of the Regulation.

- compensation payments from insurance policies.

Grants under this scheme should not be included.

Group

Combined group applications

If a group submits a combined application as if the group were a single enterprise, it is the group’s consolidated calculated loss (after eliminations) during the grant period which must be used as a basis.

Individual applications

If the individual enterprises in a group apply separately, it is each enterprise’s own calculated loss or share of the group’s calculated loss (without eliminations), whichever is lower, that limits the grant that can be awarded.

In this case, the calculated loss within the group will be the sum of all the group companies’ calculated results during the grant period, including the profit/loss of enterprises that do not intend to apply and the profit/loss of foreign enterprises.

The individual enterprises within the group must agree with the responsible enterprise how much of the group’s loss they can use in their application. If the group has a calculated profit overall, no company in the group may apply for grants.

The loss must be calculated and documented for all enterprises in the group in accordance with Section 1-6. It should be noted that the definition of a group covers more enterprises than are normally considered to be part of a group. Find out more about the definition of group in Section 1-6 here.

The Group’s calculated deficit during the grant period in accordance with Section 3-1 third paragraph of the Regulation comprises the sum of the calculated deficit during the grant period recorded by the enterprises in the group pursuant to Section 1-6 of the Regulation. If a group submits a joint application as if the group were a single enterprise, the group’s calculated deficit during the grant period should be used.

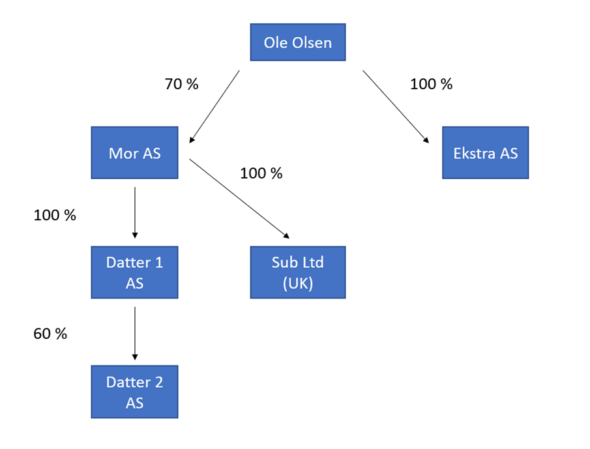

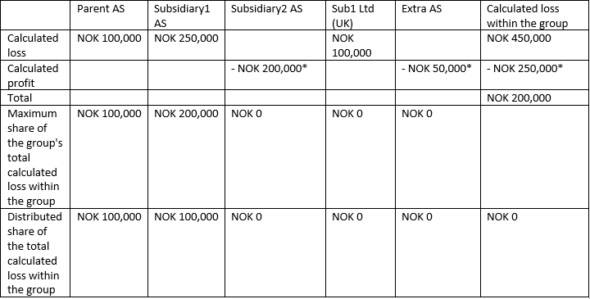

Example – shareholdings and estimated loss in group

The group chart below shows shareholdings, while the table shows the share of calculated loss in the case of individual applications.

Share of calculated loss

* In the application, the calculated loss must be entered as a positive amount. Calculated profits must therefore be entered here as a negative amount (minus).

Example list for calculating the deficit:

| A – Cost incurred during the grant period | Amount |

| Salary and other personnel costs | |

| Cost of goods | |

| Change in inventory of semi-finished and finished goods | |

| Depreciation of fixed assets and intangible assets | |

| Other operating costs | |

| Net interest expense in accordance with Section 3-2 third paragraph, but such that the negative net interest cost must also be included | |

| B – Turnover etc. during the grant period | |

| Turnover to be used to calculate the drop in turnover | |

| Financial compensation from other grants to cover loss of revenue | |

| Financial compensation from insurance policies to cover loss of revenue | |

| C – Calculated deficit during the grant period | |

| A minus B. Set to zero if this becomes a negative amount. |