The state aid rules that currently form the basis for the grant scheme distinguish between small, medium and large enterprises. The support rate is highest for small enterprises. It is therefore important to be aware of the criteria which determine when an enterprise can be considered to be small.

For small enterprises, grants will be calculated on the basis of 90 percent of the deficit during the grant period, while for the other enterprises, support will be calculated on the basis of 70 percent of the deficit.

Small enterprises means enterprises for which the most recently annual accounts show that:

- average number of employees during the financial year is less than 50 full-time equivalents, and that

- sales revenue or balance sheet total does not exceed NOK 107,228,000 (EUR 10 million)

The enterprise may exceed one of the values for turnover or balance sheet total, but not both.

Medium enterprises means enterprises that are not small enterprises and for which the most recently approved annual accounts show that:

- average number of employees during the financial year is less than 250 full-time equivalents, and that

- sales revenue does not exceed NOK 536,140,000 (EUR 50 million), or

- balance sheet total does not exceed NOK 461,080,400 (EUR 43 million).

The enterprise may exceed one of the values for turnover or balance sheet total, but not both.

Large enterprises means enterprises that are not a small or medium enterprise.

In the calculation, the number of employees, sales revenue and balance sheet total from the most recently approved annual accounts of certain other enterprises with a specific link to the applicant enterprise must also be included. This mainly concerns:

- owners who, either alone or jointly with other enterprises in the same group, hold 25 percent or more of the capital or votes in the applicant enterprise

- enterprises where the applicant enterprise, either alone or jointly with other enterprises in the same group, hold 25 percent or more of the capital or votes

If the ownership share is more than 50%, 100% of the number of employees, turnover and balance sheet total must be included. If the ownership share is between 25 and 50%, a proportional share of the number of employees, turnover and balance sheet total must be included.

The calculation is governed by the SME definition in Annex 1 to the EU’s Block Exemption Regulation (from page 1133). The annex sets out the detailed rules concerning the enterprises that are to be included and the figures for employees, turnover and balance sheet total that are to be used.

You can find out more about the calculation for small enterprises and see various examples of ownership compositions which are to be included in the calculation in Chapter 6 of Innovation Norway’s guide to the EEA Agreement’s state aid rules and in the EU’s user guide to the definition of small enterprises.

Documentation requirements

In order to document whether the enterprise you are applying on behalf of is covered by the definition of a small enterprise, a list must be drawn up showing the enterprises that are included in the calculation and the associated ownership shares applicable at the time of application. The most recently approved annual accounts of these enterprises must be obtained. An updated shareholder register for the enterprise you are applying on behalf of must also be presented to the person responsible for verifying the application.

Example of a list of ownership shares

A list of ownership shares might look like this:

| The applicant’s ownership shares in other enterprises | Owner of the applicant enterprise | Org.no. | Ownership share in percent | Sales revenue | Balance sheet total | Number of employees |

|---|---|---|---|---|---|---|

| Company A AS | 987654321 | 26 | 5 000 000 | 2 500 000 | 7 | |

| Company B AS | 976854321 | 51 | 10 000 000 | 5 000 000 | 6 | |

If “Company A AS” holds 26% of the voting rights in the applicant, 26% of this enterprise’s average number of employees in the financial year, 26% of sales revenue and 26% of the balance sheet total of this enterprise must be included in the calculation to determine whether or not the applicant is covered by the provision for small enterprises.

The applicant owns 51% of “Company B AS”. 100% of the average number of employees during the financial year, 100% of sales revenue and 100% of the balance sheet total of this enterprise must then be included in the calculation.

Other examples (illustrations and text taken from Innovation Norway: Guidance on the EEA Agreement’s state aid rules):

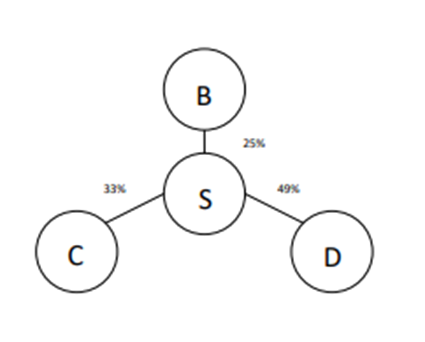

Example 1:

Applicant enterprise S owns 33% of C and 49% of D, and B owns 25% of S

Beregningen blir:

Totale verdier = 100 % av S + 25 % av B + 33 % av C + 49 % av D

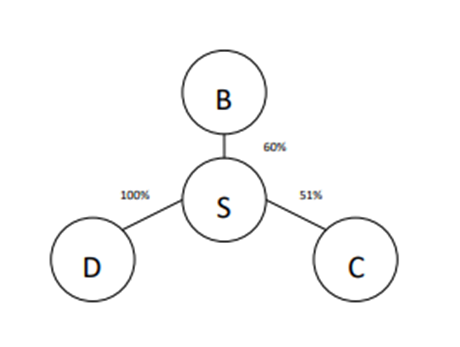

Example 2

Applicant enterprise S owns 51% of C and 100% of D, and B owns 60% of S

The calculation will then be as follows:

Total value = 100% of S + 100% of B + 100% of C + 100% of D.

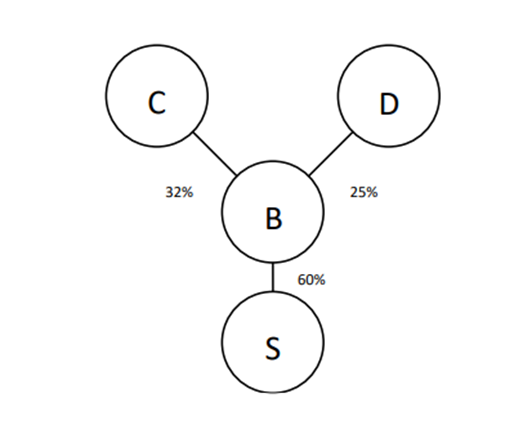

Example 3

Applicant enterprise S is affiliated to B, which owns 60% of S. However, B is owned by C and D, which respectively own 32% and 25% of B.

The calculation will then be as follows:

Total value: 100% of S + 100% of B (B + 32% of C + 25% of D).

Insufficient documentation

If you are unable to obtain satisfactory proof that the enterprise you are applying on behalf of is covered by the definition of a small enterprise, you can opt to apply as a medium enterprise and use the calculation method for this group. As a medium or large enterprise, up to a maximum of 70% of the deficit can be covered (factor of 0.7). It should be noted that the enterprise must then also satisfy the requirement not to have been experiencing financial difficulties before March 2020.

When calculating the amount limits stated above, an exchange rate of NOK 10.7228 per euro must be used.